How to Improve Your Credit Score Before Buying a Home

/What are the best ways to improve your credit score so you can qualify for a mortgage?

To boost your credit score before buying a home, focus on reducing debt, making on-time payments, and managing your credit responsibly. These steps can make a big difference when it comes time to qualify for a mortgage—and get a better rate.

Why Your Credit Score Matters When Buying a Home

Your credit score plays a big role in your mortgage approval and the interest rate you’ll get. Lenders use it to assess how reliable you are with debt—and it can impact whether you’re approved, how much you can borrow, and what your monthly payment looks like.

If your score is on the lower side, don’t panic. Improving your credit doesn’t have to take years. With the right strategy, you could start seeing results in just a few months.

Tip #1: Make Payments On Time, Every Time

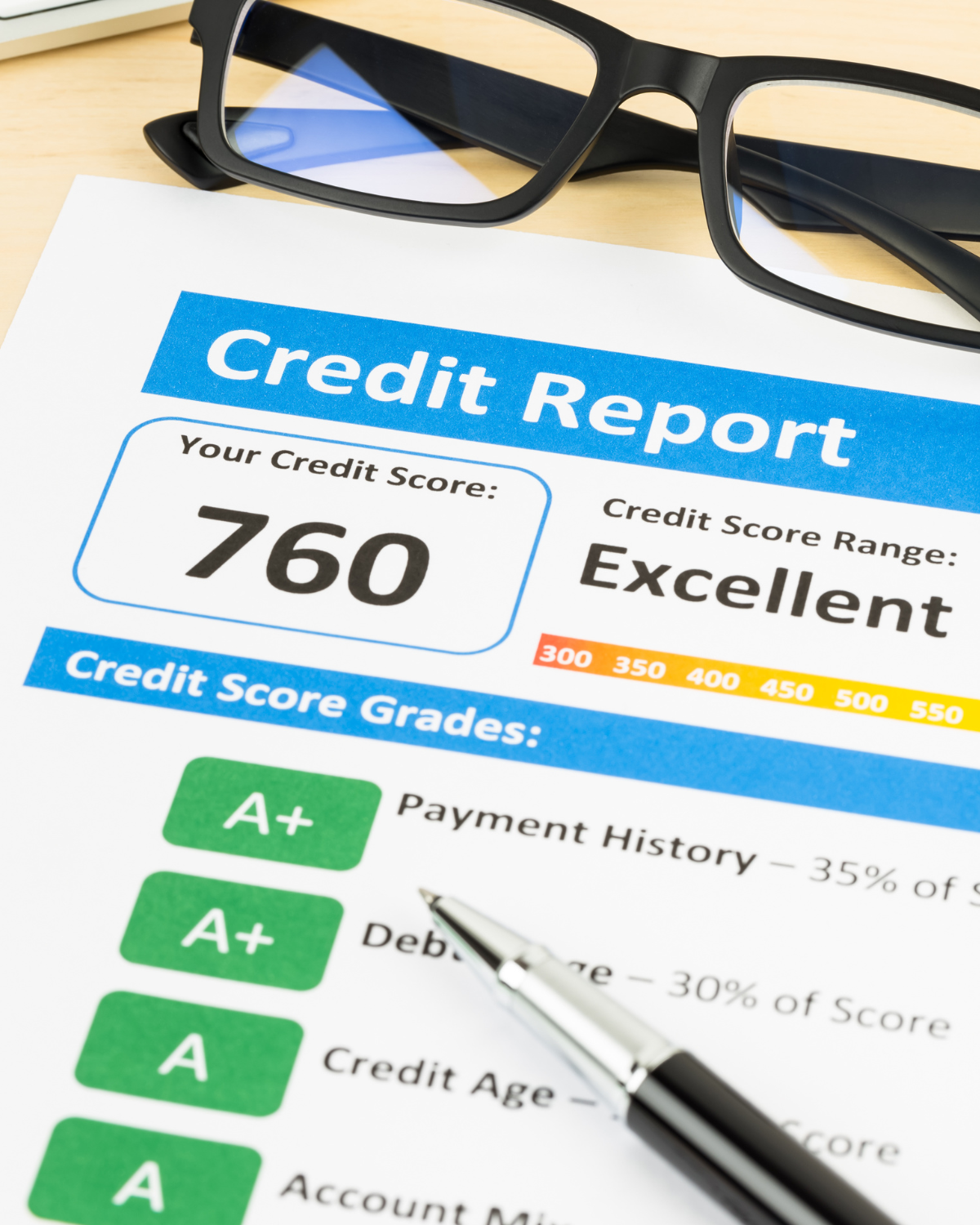

Payment history makes up 35% of your credit score. That means even one missed payment can drag your score down.

Set up reminders or auto-pay for:

Credit cards

Car loans

Student loans

Any other debt

Even paying the minimum on time is better than missing a payment.

Tip #2: Pay Down Credit Card Balances

Your credit utilization ratio—how much of your available credit you’re using—makes up another 30% of your score.

Try to keep your balances below 30% of your credit limits. If possible, aim for even lower.

For example:

If you have a $5,000 credit limit

Try to keep your balance under $1,500

Paying down even one credit card can give your score a quick lift.

Tip #3: Avoid Opening New Accounts

Every time you apply for a new credit card or loan, it triggers a “hard inquiry,” which can temporarily lower your score.

Unless necessary, avoid taking on new debt while preparing to buy a home. Focus instead on managing your current accounts wisely.

🎥 Want help mapping out a plan?

Reach out, and I can connect you with the best lenders to help get you on the right path.

Tip #4: Don’t Close Old Accounts

It might seem smart to close old or unused credit cards, but that can actually hurt your score. Why?

You reduce your available credit (which affects your utilization ratio)

You shorten your credit history

Unless a card has high fees or is causing trouble, consider keeping it open and active with small, manageable purchases.

Tip #5: Check Your Credit Report for Errors

Sometimes credit scores drop because of mistakes—like accounts you never opened or payments marked late that weren’t.

You can request a free credit report from:

Review everything carefully and dispute any inaccuracies you find.

Final Thoughts: You’re Closer Than You Think

Improving your credit score might feel overwhelming, but small, consistent actions go a long way. Whether you’re 3 months or 12 months away from buying a home, the best time to start is now.

If you’re thinking about buying in Winnipeg and want personalized guidance, let’s chat. I can help you prepare your credit, navigate your mortgage options, and start the path toward homeownership.

Ready to Talk Strategy?

📅 Schedule a free consult with Nicole Hacault

🎥 Watch my video on credit scores + mortgages